Posts Tagged: employer

News

Inspired by their union-yearning congressional counterparts, state Capitol employees have taken to social media with anonymous posts about bad bosses and a percolating desire for the same bargaining rights enjoyed by other state workers. The Instagram account, “DearCaStaffers,” had about 2,700 followers by Thursday. That was 400 more than the day before.

News

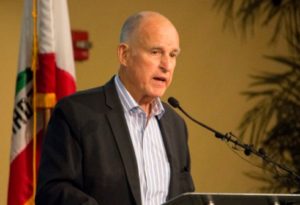

In the nearly seven years he’s been governor, Jerry Brown’s been frank about why he’s supported bold criminal justice reform, like Prop. 57, the 2016 ballot measure that, among other things, offers sentence credits to inmates who take advantage of rehabilitative programming. “I helped screw things up, but I helped unscrew things,” he said Friday at a forum put on by the California Prison Industry Authority, the state agency that provides work assignments and job training for state prisoners.

News

New York state pension systems are better funded than California state pension systems, currently take a smaller bite out of state and local government budgets, and still provide pension benefits well above the national average. How do they do it?

News

Because the system is underfunded, the CalSTRS board has made no inflation adjustment in the death benefit since 2002. The board was told that it could have increased the death benefit by about 34.7 percent during the period.

News

Calpensions: President Obama said he has directed his labor department to propose rules showing states how to create what in California could be an “automatic IRA,” a payroll deduction that puts money into a tax-deferred savings plan unless workers opt out. The rules are expected to answer a key question: Is Secure Choice exempt from a federal retirement law, ERISA, that not only has employer administrative costs but may also expose employers to liability for failed investments and other problems?

News

CalPERS is considering small increases in employer and employee rates over decades to reduce the risk of big investment losses, a policy that also would lower an earnings forecast critics say is too optimistic. The proposal is a response to the “maturing” of a CalPERS system that soon will have more retirees than active workers. From two active workers for each retiree in 2002, the ratio fell to 1.45 to one by 2012 and is expected to be 0.8 to 0.6 to one in the next decades.

News

Calpensions: A California plan to give private-sector workers a state-run retirement savings plan is nearing $1 million in contributions, the goal set to pay for a market analysis to help design the program. Although the California plan is still in the formative stage, last week the Illinois legislature approved a plan based on the California model, even using the same name, “Secure Choice.”

News

Bankrupt San Bernardino announced an agreement with CalPERS last week to pay off an unprecedented pension debt owed for skipping payments to the pension fund for a year — $13.5 million, plus several million more in penalties and interest. Details of the agreement reached in closed mediation were not released. But the city said in a court filing the CalPERS agreement “will help form the basis” for a debt-cutting plan needed to exit bankruptcy.

News

Full funding of the troubled California State Teachers Retirement System has been approved by the Legislature, with most of the additional $5 billion coming from school districts that get no offsetting money from the state.

News

It had a name, Secure Choice, and now an attempt to create the first state-run “automatic IRA” for workers with no retirement plan has its first donors, authorization to hire consultants and a favorable response from a wide range of groups asked for advice. The author of the program, Sen. Kevin de Leon, D-Los Angeles, may become the next leader of the state Senate. So the plan being developed by a nine-member board could have a strong advocate when it comes back to the Legislature for approval.