News

LAO: A summary of the governor’s 2018-19 budget

Gov. Jerry Brown presents his 2018-19 budget draft to the Legislature. (Photo: Corben Wilson, Capitol Weekly)

Gov. Jerry Brown presents his 2018-19 budget draft to the Legislature. (Photo: Corben Wilson, Capitol Weekly)Ed’s Note: On Jan. 10, the governor presented his initial 2018‑19 budget plan to the Legislature. In this report, the Legislative Analyst provides a brief summary of the governor’s proposed budget. (In the coming weeks, the LAO will analyze the plan more thoroughly and release several additional budget analysis publications.)

Governor Prioritizes Reserves.

The Governor’s 2018‑19 proposed budget places a high priority on building reserves. To that end, the Governor proposes a total reserve balance of nearly $16 billion, including an optional $3.5 billion deposit into the state’s rainy day fund. We believe the Governor’s continued focus on building more reserves is prudent in light of economic and federal budget uncertainty. In considering the Governor’s proposal, we advise the Legislature to first set its own optimal level of reserves in preparation for a future recession.

Governor Allocates Funding Increases for Schools and Community Colleges.

Under the administration’s estimates, there are sizeable resources available to allocate within the constitutionally required funding guarantee for schools and community colleges. The governor makes a few major decisions in allocating these funding amounts. These include: (1) fully funding the implementation of the K‑12 Local Control Funding Formula, (2) increasing community college apportionments and implementing a new allocation formula, and (3) creating a new high school career technical education program.

Governor Makes Various Infrastructure Proposals.

After setting aside reserves and fulfilling constitutionally required spending, the governor uses some discretionary funds for a variety of new infrastructure projects. While these proposals have merit, the Legislature may wish to consider whether it has a different set of priorities for infrastructure spending. Moreover, while many of the infrastructure proposals in the governor’s budget include relatively small spending amounts for 2018‑19, some carry growing and significant costs in later years.

More Resources May Be Available in May.

The Legislature may have more resources available to allocate in May for two reasons. First, the administration’s revenue estimates may be higher. Second, the Congress may authorize a higher federal cost share for the Children’s Health Insurance Program, resulting in General Fund savings.

The Big Picture

This section presents a broad overview of the governor’s proposed budget. Figure 1 shows the governor’s key budget proposals. These focus on three areas of the budget:

- Building more reserves.

- Allocating sizeable funding increases available within the constitutionally required guarantee for schools and community colleges.

- Supporting a variety of new infrastructure proposals.

Figure 1

Key Features of the Governor’s Budget Plan

|

Reserves |

|

Proposes extra deposit of $3.5 billion into rainy day reserve (in addition to $1.5 billion in required deposits). |

|

Proposes discretionary reserve balance of $2.3 billion. |

|

Schools and Community Colleges |

|

Fully funds the Local Control Funding Formula ($2.9 billion). |

|

Provides $396 million in additional apportionment funding for community colleges and changes the allocation formula. |

|

Proposes a new high school career technical education program ($212 million). |

|

Creates an online community college ($100 million one time, $20 million ongoing). |

|

Provides $1.8 billion in one‑time per pupil discretionary grants. |

|

Infrastructure and Equipment |

|

Provides $375 million for the design and construction of trial courts. |

|

Proposes $134 million to purchase new voting systems in counties. |

|

Provides $136 million for infrastructure projects and equipment at correctional facilities. |

|

Proposes various other infrastructure projects and equipment purchases. |

|

Other |

|

Extends and changes business tax credits (future annual losses of over $200 million). |

|

Provides $210 million for trial court operations. |

|

Provides $92 million each for CSU and UC, a 3 percent General Fund base increase for both segments. |

|

Provides $131 million for counties to address Incompetent to Stand Trial wait list. |

Below, we discuss the administration’s estimate of the overall condition of the General Fund under these proposals. Then, we discuss how new federal tax changes may affect state revenues.

The General Fund Condition

Governor Proposes $15.7 Billion in Total Reserves

Figure 2 shows the General Fund’s condition from 2016‑17 through 2018‑19 under the governor’s budget assumptions and proposals. The administration proposes to end 2018‑19 with $15.7 billion in total reserves. This would consist of two amounts: $13.5 billion in the state’s constitutional rainy day fund (reserves available for future budget emergencies), as well as $2.3 billion in discretionary reserves (available for any purpose). The budget would increase the rainy day fund by over $5 billion in 2018‑19, including an optional $3.5 billion deposit.

Figure 2

General Fund Condition Under Administration’s Estimates

(In Millions)

|

2016‑17 Revised |

2017‑18 Revised |

2018‑19 Proposed |

|

|

Prior‑year fund balance |

$5,029 |

$4,610 |

$5,351 |

|

Revenues and transfers |

118,669 |

127,252 |

129,791 |

|

Expenditures |

119,087 |

126,511 |

131,690 |

|

Ending fund balance |

$4,610 |

$5,351 |

$3,452 |

|

Encumbrances |

1,165 |

1,165 |

1,165 |

|

SFEU balance |

3,445 |

4,186 |

2,287 |

|

Reserves |

|||

|

SFEU balance |

$3,445 |

$4,186 |

$2,287 |

|

BSA balance |

6,713 |

8,411 |

13,461 |

|

Total Reserves |

$10,158 |

$12,597 |

$15,748 |

|

SFEU = Special Fund for Economic Uncertainties (discretionary reserve) and BSA = Budget Stabilization Account (rainy day fund). |

|||

Higher Revenue Estimates. Relative to the June 2017 budget package, the administration estimates that General Fund revenues will be $1.2 billion higher across 2016‑17 and 2017‑18 combined. In 2018‑19, the administration projects revenues will grow by $5.8 billion (4.5 percent). Most of this increase is attributable to the personal income tax, which grows by an estimated $4.2 billion (4.7 percent). The administration also estimates a 2017‑18 ending balance in the state’s discretionary reserve fund of $4.2 billion.

Higher 2017‑18 Spending. Relative to the June 2017 budget plan, General Fund expenditures in 2017‑18 are higher by $1.4 billion. This increase is partially due to new spending of $760 million for response and remediation related to the California wildfires in late 2017. (The state may receive reimbursements from the federal government for much of these costs in the future.) In addition, the administration estimates that 2017‑18 spending for the Medi‑Cal program will be $544 million higher relative to the June 2017 estimates. This increase is due to the net effect of multiple factors.

Lower 2016‑17 Spending. Relative to the June 2017 budget plan, the administration’s January estimates of General Fund expenditures in 2016‑17 are lower by $2.3 billion. This downward revision includes lower spending of: about $700 million for health and human services programs, nearly $500 million in General Fund spending for schools and community colleges (due to offsets from increased local property tax revenue), and $360 million for several natural resource programs.

2018‑19 Budget Plan

In this section, we describe key features of the Governor’s 2018‑19 General Fund proposed budget. We first describe increases that result from constitutionally required spending and recent legislative changes. We then describe how the Governor allocates discretionary resources available after fulfilling these commitments.

Provides $4.5 Billion in Constitutionally Required General Fund Increases. The state has two key constitutional spending formulas, which each year require the state to spend minimum amounts. The first—required by Proposition 98 (1988)—is a formula for determining the minimum amount of state funding for schools and community colleges. The second—required by Proposition 2 (2014)—is a formula that requires state spending on debt payments and reserve deposits into a rainy day fund. These formulas generally require more spending and rainy day fund deposits as General Fund tax revenues increase. Reflecting in part the administration’s revised revenue estimates, the gvernor’s budget proposal provides $1.5 billion for constitutionally required increases in General Fund spending on schools and community colleges between 2016‑17 and 2018‑19. In addition, the budget provides $1.5 billion each ($3 billion total) for constitutionally required debt payments and rainy day fund deposits.

Budget Implements Various Legislative Initiatives and Agreements. The proposed budget next funds caseload growth, primarily in health and human services programs, and implements a variety of legislative initiatives and agreements from recent years. For example, in 2018‑19, the budget allocates $170 million in Proposition 56 (2016) revenues for year‑over‑year growth in the Medi‑Cal program and $680 million to fund payment increases for Medi‑Cal providers. The amount for payment increases is largely consistent with a two‑year agreement reached in the 2017‑18 budget package. However, it is less than the fully authorized amount of $800 million because, according to the administration, a portion of the spending will shift to 2019‑20. The budget also provides $69 million to complete a multiyear agreement to increase slots and reimbursement rates for child care and preschool providers. In addition, the budget allocates $29 million to provide eight hours of paid sick leave per year for In‑Home Supportive Services providers, consistent with 2016 legislation that also increased the state’s minimum wage.

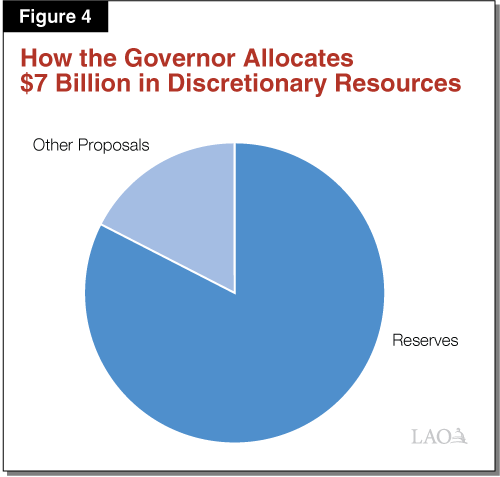

Governor Prioritizes Growing Reserves. After satisfying constitutional requirements and providing funds for caseload growth and new legislation, the Governor identifies $7 billion in available discretionary resources. As Figures 3 and 4 show, the Governor proposes using the vast majority of these resources to grow the state’s combined discretionary and mandatory budget reserves to nearly $16 billion—about 12 percent of estimated General Fund tax revenues in 2018‑19. In particular, the governor proposes an optional deposit into the state’s constitutional rainy day fund of $3.5 billion in 2018‑19 (in addition to the $1.5 billion mandatory deposit). This increase in rainy day fund reserves would bring that account’s total balance to $13.5 billion, which the administration estimates is equal to the rainy day fund’s current constitutional maximum of 10 percent of General Fund tax revenues. As shown in the figures, after setting aside these reserves, the governor uses the remaining discretionary funds for mostly one‑time and some ongoing new budget commitments.

Figure 3

Governor’s Key Choices in Allocating Discretionary General Fund Resources*

(In Billions)

|

Amount |

|

|

Reserves |

|

|

Extra rainy day fund deposit |

$3.5 |

|

Discretionary reserve balance |

2.3 |

|

Subtotal |

($5.8) |

|

Other Proposals |

|

|

Infrastructure and equipment |

$0.4 |

|

Funding for trial court operations |

0.2 |

|

Base increases for CSU and UC |

0.2 |

|

Funding increases for child care and preschool |

0.1 |

|

Funds for counties to address IST** wait list |

0.1 |

|

Other |

0.2 |

|

Subtotal |

($1.2) |

|

Total |

$7.0 |

|

*Table excludes spending on K‑14 education, reserves, and debt required by the State Constitution and funding for caseload and recent legislation. Also excludes some discretionary funding below $50 million. **IST = Incompetent to Stand Trial. |

|

No Added Funding to Medi‑Cal From Proposition 55. In 2016, voters passed Proposition 55, which extended tax rate increases on high‑income Californians. Proposition 55 includes a budget formula that goes into effect in 2018‑19. This formula aims to provide up to $2 billion of additional annual funding for the Medi‑Cal program in certain cases when General Fund revenues exceed constitutionally required spending for schools and the “workload budget” costs of government programs that were in place as of January 1, 2016. The Director of Finance is given significant discretion in making calculations under this budget formula. While the administration acknowledges that it had billions of surplus General Fund dollars to allocate to discretionary reserve deposits and some new spending in the overall budget, its Proposition 55 formula calculation identifies a $1.9 billion deficit in funding workload budget costs. As a result, the governor’s plan provides no additional funds for Medi‑Cal in 2018‑19 under Proposition 55.

$12 Billion of Gann Limit Capacity Estimated. Under the administration’s 2018‑19 General Fund and special fund estimates, the state would be left with $12 billion of “room” (essentially, extra spending capacity) under its constitutional spending limit, known as the “Gann limit.” After the administration withdrew its proposal last year to change the state’s administration of the Gann limit, we understand that Department of Finance staff reviewed its Gann limit calculations. This year’s estimate of $12 billion of Gann limit room includes an approximately $8 billion upward revision since last year in the state’s estimated costs to meet federal health and human services mandates, which are excluded from the limit.

Revenues and Federal Tax Law

Revenues Likely to Be Higher Than Estimated. Prior to passage of the federal tax bill, our office’s November 2017 Fiscal Outlook estimated that General Fund revenues would be billions of dollars higher than prior administration estimates in 2017‑18 and 2018‑19 combined. Our November estimates for the four largest General Fund taxes are a combined $3.4 billion higher than the administration’s new January 2018 revenue estimates. Currently, our assessment is that state revenues in 2017‑18 and 2018‑19 combined will most likely be higher than the administration’s new estimates. That being said, the recent federal tax legislation introduces significant new uncertainties to typically uncertain state revenue projections, as discussed below.

Federal Action Not Yet Reflected in Governor’s Proposal. The president and the Congress agreed to major changes to federal individual, corporate, and estate taxes in December 2017. By that time, many key elements of the administration’s budget plan already had been completed. As such, the administration’s January 2018 budget plan generally does not reflect changes to the economy and taxpayer financial decisions that will result from the new tax law. The May Revision is expected to reflect some changes resulting from the federal plan.

Federal Law Already Affecting Revenues. In December 2017, the state experienced a multibillion‑dollar revenue influx. This revenue surge likely resulted from (1) economic growth and high stock prices and (2) decisions of individuals and businesses to maximize their near‑term benefits under the new federal tax law. Similar factors probably contributed to record high daily levels of personal income tax withholding in early January 2018.

In general, when the federal government passes new tax laws, individuals and businesses have incentives to accelerate some income and expenses (and delay other types of income and expenses) in order to maximize their benefits under the tax code. These “shifts” in taxpayer income and expenses likely have boosted state tax receipts by billions of dollars during the last few weeks. In the coming months, these shifts may boost state revenues in some months and depress revenues in other months. (For example, the upcoming mid‑January round of quarterly income tax payments may be smaller than usual because many high‑income people sent their payments in December.) A fuller understanding of what is happening will take months or years to develop.

Effects on U.S. Economy. In addition to the taxpayer shifts described above, a significant change to federal taxes affects the national economy. These effects are complicated, difficult to determine with precision, and potentially variable from one part of the country to another. Economic effects also often differ in the short run and the long run.

In the short run, many economic analysts expect the plan to boost national economic growth through the end of this decade. One key reason is that the federal plan reduces various taxes on businesses. Moreover, in the near term, a large portion of the nation’s taxpayers is expected to benefit from a decline in their federal taxes. These tax reductions are expected to stimulate the national economy, temporarily boosting growth. For example, Moody’s Analytics anticipates that the tax law will boost real gross domestic product growth by four‑tenths of a percentage point in 2018, with a smaller boost in 2019.

In the longer run, this short‑term economic stimulus is expected to diminish. With unemployment rates now low, wage and price pressures caused by the stimulus could create new economic concerns. Higher federal deficits and resulting higher interest rates may depress economic growth below what it would have been. Because many of the federal plan’s features were temporary, there is also uncertainty about which features will be extended in future years. Moody’s Analytics projects that the net economic boost from the tax plan will be small over the long term—increasing U.S. economic growth by 0.05 percentage points per year.

Effects on California. The tax plan’s short‑ and longer‑run effects on the U.S. economy—discussed above—willaffect the California economy too, including near‑term reductions in federal taxes for a large portion of individual Californians and businesses. Concerns have been expressed about parts of the federal plan that could have a disproportionately negative effect on California and other states that have higher taxes and home prices. For example, about 15 percent of California individual income tax filers—largely those making $100,000 or more per year—reportedly claimed $10,000 or more in state and local tax (SALT) deductions under the prior tax law. These deductions will now be capped, and some of these filers will pay more in individual income taxes under the plan. In addition, changes to the SALT and mortgage interest deductions have led some to conclude that growth in California house prices will slow under the new tax law. Offsetting these concerns are the plan’s significant reductions in corporate and other business taxes, the benefits of which are likely to help high‑income earners with significant stock holdings and other investments.

Upcoming Tax Agency Report. California state income taxes generally do not automatically conform to changes in federal tax law. Yet, the recent changes to federal tax law will result in various changes in state taxpayer liabilities or behavior—some of them indirect or unintended. The Franchise Tax Board (FTB) is already required to provide a consolidated report by April 20 on how the new federal law will affect state tax revenues. It will be impossible for FTB to identify all potential issues related to the plan with precision in such a short time frame, but this information should be useful for finalizing the budget after the May Revision and considering possible changes to state tax law this year or in the future.

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.

Leave a Reply