News

CalPERS eyes new rate hike

To cover the cost of retirees living longer, the CalPERS board next month is expected to approve the third rate hike in the last two years, phasing in the increase to soften the blow on state and local governments.

The new rate hike would not begin until fiscal 2016-17 to allow employers time to plan after receiving rate projections next year. When fully phased in by 2020-21, the new rate hike and the previous two would raise rates roughly 50 percent above current levels.

In the first rate increase in March 2012, CalPERS lowered its investment earnings forecast from 7.75 to 7.5 percent, but critics say that’s still too optimistic. In a second rate increase last April, CalPERS adopted new actuarial methods that pay off debt sooner.

Now to reflect new longevity estimates (two more years for males and 1½ years for females) CalPERS plans a third rate hike. Employers have been told a longevity rate hike is likely, but the jump may be larger than some expected.

“Concern has been raised that the contribution increases may be too much for employers to bear,” said the report from Alan Milligan, California Public Employees Retirement System chief actuary, and David Lamoureux, deputy chief actuary.

As CalPERS reviews economic and demographic assumptions, usually done every four years, the board has leaned toward a new investment allocation that, if adopted next month, is unlikely to change the earnings forecast and trigger yet another rate hike.

A staff report to the board last month said a rate increase resulting from changes in the other assumptions, mainly longevity, will have a “significant impact” on employers at a time when their budgets are strained.

“Concern has been raised that the contribution increases may be too much for employers to bear,” said the report from Alan Milligan, California Public Employees Retirement System chief actuary, and David Lamoureux, deputy chief actuary.

There is no easy way out. Delaying action on the longevity change could lead to a “qualified” actuarial valuation reflected on the financial statements of CalPERS and state and local governments. Delaying a rate increase boosts the long-term cost.

Following current CalPERS policy, staff recommends a five-year phase in of the rate hike to pay off the new longevity debt over 20 years. For each $1 million in debt or “unfunded liability” the interest payment is said to be $1.2 million.

Two alternatives given to the board phase in the rate hike over seven years and pay off the debt over 30 years. With a 30-year payment period, for each $1 million in debt the interest payment nearly doubles, jumping to $2.2 million.

For the pension fund, the longevity rate hike would drop the funding level, now 74 percent, four points to 70 percent, and liabilities, now $329 billion, would increase $22.6 billion. (The unfunded liability, not covered by projected assets, is $57 billion).

For employers, the staff report has a chart showing estimates of the rate increases in the first and fifth year when, under current policy, the longevity rate hike is phased in over five years and the debt paid off over 20 years.

In the giant CalPERS system, there is a wide variation among the 1,581 local governments with more than 2,000 plans. For example, the estimated year-five longevity rate increase for a common miscellaneous plan is a range, 2.4 to 4.8 percent of pay.

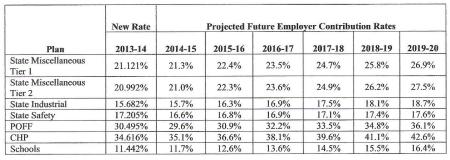

If the new longevity estimates are combined with a previous six-year projection of CalPERS rates for the state and schools (annual actuarial valuation, p. 61), it’s possible to get a rough look at what the total employer rate might be in 2020.

The employer rate for most “miscellaneous” state workers, now 21 percent of pay, could be around 32 percent in six years. Employees currently contribute 8 percent of pay, which only increases if agreed to in labor contract bargaining.

The employer rate for the California Highway Patrol, now 35 percent of pay, could be around 55 percent in six years. The employer rate for non-teaching school workers (the largest CalPERS group), now 11 percent of pay, could reach 20 percent.

In the giant CalPERS system, there is a wide variation among the 1,581 local governments with more than 2,000 plans. For example, the estimated year-five longevity rate increase for a common miscellaneous plan is a range, 2.4 to 4.8 percent of pay.

A slide shown the board had a 40-year estimate of the impact of the longevity rate hike on a sample local miscellaneous plan. The current employer rate, 15 percent of pay, would increase to nearly 22 percent and remain there for a decade before dropping.

(The blue line in the slide is the staff recommendation, the green line is one of the alternatives with a 20-year payment period, and the yellow line is no rate change to cover the increased longevity.)

For one large city, Sacramento, the proposed longevity rate hike would cost an estimated $12.2 million by the fifth year, the equivalent of 102 full-time positions, Leyne Milstein, Sacramento finance director, told the CalPERS finance committee last month.

“Mr. Milligan provided several charts that alluded to the percentage impact,” she said. “What I wanted to share with you is really that dollar impact.”

A chart Milstein gave the committee showed the five-year $12.2 million cost potentially reducing 34 police officer positions ($135,000 each), 30 firefighter positions ($131,000) and 38 miscellaneous employee positions ($97,000).

“We need to be reasonable in how we get there, given what we and other local government agencies and the state have gone through over the past seven or eight years,” she said.

“I would believe well into the fifth year that we are talking about filled positions and more than likely actual layoffs,” she said.

Milstein said Sacramento had deficits for eight years, budget cuts for six years and reduced 1,200 general fund positions. She said revenue for the $370 million general fund is expected to grow 3 percent a year, just enough to keep up with growing expenses.

A recent city budget forecast, Milstein said, includes a voter-approved ½ cent sales tax that expires in 2020, previously announced CalPERS rate hikes, 1 percent salary growth and no increase in health costs.Milstein said she understands the need to raise rates to cover the cost of retirees living longer. She said the board should consider some of the alternatives that ease the financial blow.

“We need to be reasonable in how we get there, given what we and other local government agencies and the state have gone through over the past seven or eight years,” she said.

Several board members thanked Milstein, the only local government representative who spoke to the committee during the public comment period.

“One of my complaints to CSAC and the League is we don’t see enough of you here to talk,” said board member Richard Costigan, referring to the California League of Cities and the California State Association of Counties.

But the normal cost for most safety plans is expected to increase by 1 to 3 percent of pay, triggering a contribution increase.

For employees, the proposed longevity rate hike could trigger a contribution increase of 0.5 to 1 percent of pay for some new hires in local government and schools, mainly police, firefighters and other safety workers.

Gov. Brown’s pension reform that took effect last year, AB 340, requires these new hires to pay at least half of the pension “normal cost,” benefits earned during a year. Employers continue to pay all of the debt or “unfunded liability” from previous years.

The pension contribution paid by new employees is adjusted if the normal cost changes by more than 1 percent. The longevity rate hike is expected to change the normal cost for most miscellaneous workers by less than 1 percent of pay.

But the normal cost for most safety plans is expected to increase by 1 to 3 percent of pay, triggering a contribution increase.

The requirement to pay at least 50 percent of the normal cost only applies to new hires covered by the reform in local governments and schools. Milligan told the board changes in state worker pension contributions must be bargained in labor talks.

CalPERS estimate of rate hikes to cover longer lives of retirees

CalPERS projection of state and school employer rates issued last fallNpote

—

Ed’s Note: Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.