News

California poverty: The high cost of just about everything

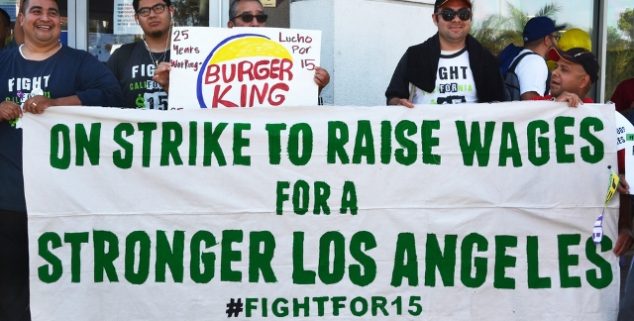

Workers in Los Angeles demonstrate in support of a $15 minimum wage. (Photo: Dan Holm, Shutterstock)

Workers in Los Angeles demonstrate in support of a $15 minimum wage. (Photo: Dan Holm, Shutterstock)High housing costs, electricity and gas prices are the main reasons California has the highest poverty rate in the nation, according to state Assembly Republican Leader Chad Mayes.

The Yucca Valley legislator has made alleviating poverty his top priority. “I think increasing the quality of life for people we serve is the overall goal,” he said. “If you have poverty as a measuring stick, California is failing worse than every other state in the country.”

As it stands now, only 31 percent of California households can afford the median price home of $515,000.

Policy experts also cite low wages and insufficient safety net as other factors contributing to California’s high poverty rate.

The US Census Bureau’s Supplemental Poverty Measure puts California’s poverty rate at 20.6 percent, just above Florida, which sits at 19 percent. By comparison, the state with the lowest poverty rate is New Hampshire at 8.7 percent. The supplemental poverty measure takes into account the cost of living, taxes, house and medical costs. The poverty threshold in California is an average of $30,000 for a two-adult, two-child family depending on the region of the state.

Mayes attributes the housing cost problem to the lack of adequate supply of homes. A McKinzie Global Institute report found that California has to build 3.5 million homes by 2025 to keep up with the demand. Even today, Mayes said, California is 2 million units shy from what it needs. “The reasons why prices are so high is we haven’t built enough,” he said.

Easing some of the burdensome regulations and permits such as environmental laws might help, he said.

Jordan Levine, senior economist with the California Association of Realtors, said that the requirements of the California Environmental Quality Act has made it harder for developers to build more houses. He said another barrier to more houses is local residents who don’t want new developments in their neighborhoods.

Levine said the lack of housing supply and high prices is making it difficult for Californians to get homes. As it stands now, only 31 percent of California households can afford the median price home of $515,000, said Levine. That compares to 57 percent of homeowners nationwide who are able to buy a median price home.

Because of the high costs, companies that offer good-paying marketing jobs don’t want to expand into California.

More people are moving to Arizona, Nevada and Texas where the economies are still growing and the median home price is half that of California or less, Levine said.

Another major factor contributing to the high poverty rate in California is energy costs, which Mayes says are 40 percent higher than the rest of the country because of regulatory burdens. This affects poorer parts of the state more. The reason is more energy is needed in the poorer inland regions where summers are hot and less is needed on the coast where temperatures are more moderate, Mayes said.

Anyone who has traveled around the country has seen that California’s gas prices are $1 or more a gallon higher than much of the country. This is because of rules about the mix of gas that has to be used and the amount of the gas tax – all that could be changed by the legislature, Mayes said.

High energy costs then translate into high costs of food and supply since suppliers have to buy electricity and gas, Mayes said. Because of the high costs, companies that offer good-paying marketing jobs don’t want to expand into California. This makes it hard for people with limited education to find high enough wages. “We don’t have the jobs that pay for those who didn’t go to Stanford or UCLA or didn’t go to Berkeley or didn’t get a degree in computer science and life science,” he said.

Eighty-percent of families with children in poverty are working but they earn too little and things cost too much.

Mark Toney, the president of The Utility Reform Network, a consumer advocate group, said rate increases with utilities like Pacific Gas & Electric have gone out of control. A number of small increases approved at different times by the California Public Utilities Commission added up to a total of 12 percent last year. That amounts to a huge burden on ratepayers, Toney said.

“How many of their jobs got a 12 percent increase last year?” he said. “I don’t know of anybody unless you are an executive.”

The higher rates have led to more disconnections and contributed to keeping people in poverty. Utility disconnections rose 44 percent from 566,000 in 2010 to 817,000 in 2015, according to TURN.

“We see disconnections as being a driver of displacement and homelessness,” Toney said. “If you don’t have utility service, a house is not habitable.”

TURN is working to stop shutoffs. The organization believes utilities should work with customers and accept partial payments rather than nothing in order to keep service turned on.

Alissa Anderson, senior policy analyst at the California Budget and Policy Center, cites another contributing factor to poverty — low wages. Eighty-percent of families with children in poverty are working but they earn too little and things cost too much.

She believes the safety nets in place don’t do enough to lift people out of poverty. The federal programs that work the best to alleviate poverty now are the earned income tax credit and child tax credit and CalFresh (food stamps). “They help millions of people better make ends meet,” she said. “We can do more to cut poverty and move people up the economic ladder.”

Anderson said there hasn’t been an increase in welfare funding since the mid-1990s even though the population has grown. The program doesn’t increase when in an economic downturn when people lose a lot of jobs. “What we need is a safety net that can automatically respond when hardship increases,” she said.

Mayes said he is committed to doing his best to work with other legislators to decrease the poverty rate.

“Our goal and our focus should be on doing our job- increasing the quality of life, providing more opportunity,” he said.

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.

Gee you completely left out the Elderly living on Social Security. If you worked 25yrs at a low paying job your benefit might be around $800.00 a month…enough to apply for food stamps…..but to get food stamps you go through the, let us look up your butt first Questions and paperwork of the welfare office. You know…how many sheets of toilet papers did you use last month?

Oh, and PG&E will cut your cost if you let them in your house any old time they want.

IF you get a $20.00 Social Security raise, they know, the following month you will get a notice of food stamp reduction, PG&E rate hike, increase in Water bill, more Phone Co. taxes, Higher Satellite charges etc. And on and on it goes!

By the way you couldn’t rent a closet in S.F. for $ 800.00.

This is simple economics… every time the state government interferes with free economy by implementing laws and regulation to increase employee benefit, job protection, minimum pay, and tax increase etc., businesses leave, and unemployment/poverty level increases.

It’s really the other way around. The Costa-Hawking Rental Housing Act of 1996, is a law that bans rental regulations on new development, basically anything built after 2/1/95. Which means that cities are not allowed to regulate the cost of units in new apartment buildings. This is simple economics and look at how everything is screwed up. The minimum wage has to go up because who can afford $2,000 a month rent on $12 an hour? Screw the “free economy,” regulations are necessary especially in housing so communities stay in tact, displacement is stopped and tenants have extra cash in their pockets so they can go spend it at local restaurants, markets, bookstores etc… and fuel the economy!

People complain about the cost of housing in California. I was searching condos in Chicago, and the taxes there are more than a house payment in California.

Mr. Mayes