Posts Tagged: taxes

News

Hang on to your hats, California smokers — a cyclone of tobacco legislation is blowing through the Golden State. Moves to crack down on electronic cigarettes, further regulate smokes in the workplace, raise the legal age to buy cigarettes to 21 years old and create new tobacco taxes all won support from the Senate health committee, the bills’ first major policy hurdle in the final weeks of the 2015 legislative session.

News

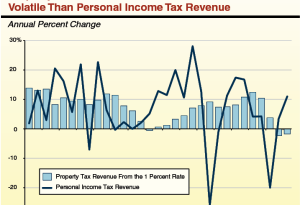

Could making our state budget more dependent on property tax revenues be the key to eliminating the roller-coaster budgets of the last two decades? Since the early 1990s, we’ve lived through the boom and bust cycles of the California budget. Today, we are more dependent than ever on personal income taxes. And those taxes are more progressive than they have been in years, meaning our economic stability is tied to the fate of the wealthy .

News

Likely voters in California are starting off the new year with some new-found optimism about the governor, the economy and — wait for it — the Legislature, according to a new survey released late Wednesday by the Public Policy Institute of California.

News

California, long bedeviled by daunting budget deficits, is likely to end the next fiscal year with $4.2 billion in reserve, with half that amount due to a budget-reform measure that voters approved on Nov. 4, according to the Legislature’s nonpartisan financial adviser.

News

In this dry summer, water is on everyone’s mind, but the Legislature will be dealing with the cost of another liquid precious to Californians – gasoline. Starting Jan. 1, gasoline prices are to be raised by an estimated 15 cents per gallon as a consequence of an increased tax on oil and gas companies to help curb release of greenhouse gas emissions.

News

As negotiations intensify over establishing internet poker in California, a study commissioned by several casino-owning tribes says online gaming could result in $845 million in revenue and more than 2,600 new jobs by 2020. The figures stem in part from an analysis of legislation that was considered – and rejected — by lawmakers last year. Similar legislation is the focus of negotiations this year, but so far an agreement has proven elusive.

News

Decades ago, California began taking over the management of thousands of acres of rural wildlands in dozens of counties across the state. But over the years a problem arose: With the state in control, some counties were cut out of the money that they otherwise would have collected from property taxes. The state had promised to compensate the counties for the lost revenue by making payments in lieu of taxes.

News

It’s a litany of good news in Gov. Jerry Brown’s election-year budget. Safety net programs are being shored up. Debt is being repaid. Revenues are rising.

Except for corporate taxes.

In fact, business tax receipts are falling at the same time hefty profits are being posted by major companies across the country. (AP Photo/Rich Pedroncelli)

News

Preliminary data from the Franchise Tax Board (FTB) indicate that December 2013 personal income tax (PIT) and corporation tax (CT) revenue collections were a combined $1.6 billion (20 percent) above monthly projections included in the state’s 2013-14 budget plan.

Opinion

OPINION: Nearly a year has passed since the California State Teachers Retirement System (CalSTRS) asked you and the Legislature to address a pension deficit for which it seeks a 30-year $240 billion cash injection, starting with $4.5 billion per year.