News

The human side of California’s housing meltdown

Newly constructed homes waiting for owners. (Photo: Jennie Book, via Shutterstock)

Newly constructed homes waiting for owners. (Photo: Jennie Book, via Shutterstock)Brianne Tufts is exhausted. This is the third place Tufts has lived in as many years, and she’s worried she’ll have to move again because her apartment complex might increase the rent now that her lease has expired.

It’s just after 11 a.m. on a Sunday in April, and the 24-year-old mother of two sits on the balcony of her cramped 2-bedroom south Sacramento apartment watching intently as her daughters play in the living room and her boyfriend, Anthony Grandinetti, cleans the kitchen.

“The uncertainty is exhausting,” Tufts said. “My daughter is 7 and she’s lived in six places already, because as soon as the lease is up, normally we’re bouncing somewhere else.”

Rising rents, the lack of new housing and stagnant wages have left Californians like Tufts struggling to afford to live in the state.

The family moved into a smaller two bedroom apartment in south Sacramento where they’re paying nearly 45 percent more than what they were in Elk Grove.

In the Sacramento region, more than 50 percent of renter households and a third of homeowner households are cost burdened, meaning they spend more than 30 percent of their income on housing, according to a 2018 PolicyLink study. This represents more than just those traditionally within “low-income” economic brackets.

In 2016, Tufts said the family was paying $895 a month living in a three-bedroom Elk Grove apartment, which was subsidized through the state’s affordable housing program. Less than a year later, they were forced to move out after an audit showed they did not meet the qualifications for the affordable housing program.

To qualify for state housing, Tufts’ family would need to make less than $22,250 per year.

Tufts said their income fluctuates, and at the time of their audit, they missed the requirement by about $100.

After moving to Grandinetti’s parents’ Galt home for a few months, the family moved into a smaller two bedroom apartment in south Sacramento where they’re paying nearly 45 percent more than what they were in Elk Grove.

“It’s a lot of juggling trying to figure out where we can kind of slack on a little bit to get the money for what needs to be paid,” Tufts explained. “But we haven’t gotten to the point yet where we have to play bill roulette.”

“Almost all folks are getting priced out”

Housing advocates across the region say the housing crisis has begun affecting more people.

Tyrone Buckley, the policy director for Housing California, said that the crisis is not limited to lower income residents. Buckley said that California is losing residents who can no longer afford to live in the state, and others are forced to relocate from regions like the Bay Area to less expensive markets like Sacramento.

This influx of new residents has helped increased housing costs in Sacramento.

“[Two years ago] we couldn’t get anyone in the Legislature to really pay attention to what we identified as a crisis in affordable housing even then.” — Tyrone Buckley

“Almost all folks are getting priced out,” Buckley said. “It’s overwhelmingly low-income and middle-income people who are leaving the state because they can’t afford to work here. In communities like Sacramento, we’re seeing it too.”

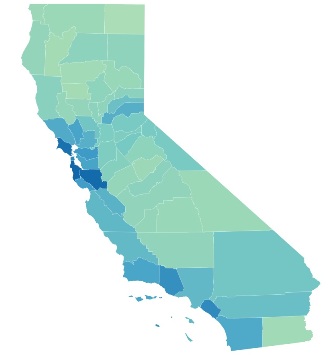

(Below: A county-by-county look at rents. Click here for the online table.)

The increasing effects of the crisis on those who are not low-income, however, has brought it to the forefront of legislators’ agendas in recent years, according to Buckley.

“[Two years ago] we couldn’t get anyone in the legislature to really pay attention to what we identified as a crisis in affordable housing even then,” Buckley said. “And it was really this acknowledgement … that people in almost all economic segments of the population were feeling the pinch from a lack of affordability, and it was actually those folks, I think, calling their legislators, those folks who legislators identified more as their voting constituency, calling them and saying they’re feeling the crunch, that they’re nurses, or police officers, or teachers, and they can’t afford to live in the community where they work. I think that drum beat really started to resonate in the legislature.”

“It was this focus on the missing middle, this voice of the missing middle that catapulted the affordable housing discussion, at least in the legislature.”

Rob Wiener, the Executive Director of the California Coalition for Rural Housing, said although the focus on middle class residents has brought the housing crisis to the forefront, there is resistance to opening up state housing relief programs to those with higher incomes.

“There’s a tension there because even though middle income people are having more and more challenges, they still have a hell of a lot more options than a low-wage worker who’s living in a rental someplace in very poor conditions,” Wiener said. “[Low income people] don’t have nearly the mobility and housing options or life chances that someone in the middle class does. So we’ve generally been resistant to opening up those programs, or even creating new programs for the missing middle, in a situation where we have very scare subsidy.”

“It always was true that new housing was marketed for higher income folks.” — Brian Uhler.

Buckley and other advocates are critical of Governor Jerry Brown’s response to the crisis, noting that the state eliminated redevelopment agencies in 2012, which had built some affordable housing.

Advocates also say Brown’s refusal to commit money from the general fund to housing has crippled the state’s ability to respond to the housing crisis.

State Finance Departmen spokesman H.D. Palmer disputed the idea that these funds would solve the problem.

“The state can only do so much,” Palmer said. “Money alone will not fix [the housing crisis].”

In 2016, Gov. Brown began pushing the idea of “filtering” — that creating more housing supply at higher income levels through the easing of building and regulations would eventually reduce housing prices statewide, lessening the burden on lower-income populations.

“I just don’t think supply in and of itself is enough.” — Rob Wiener

“It always was true that new housing was marketed for higher income folks,” said Brian Uhler, Principle Fiscal and Policy Analyst for the Legislative Analyst’s Office. “Eventually, that housing becomes older. It’s not as attractive for those high income households, so the rents in those places over time will decline.”

Buckley said this is essentially a “trickle down” approach to the housing crisis.

Wiener and other advocates, however, don’t see the potential for this approach to have much of an effect on high housing costs.

“I just don’t think supply in and of itself is enough. No one knows what that tipping point is when we’ve built enough housing, certainly market rate housing, where you have more supply than demand and those prices go down,” Wiener said.

Many still express skepticism that “filtering” will affect housing prices for middle and lower income groups.

“Even for the middle income people, the supply approach will likely take decades to trickle down to middle income people,” Buckley said. “And it will never trickle down to people raising families on extremely low-income.”

“It comes down to the resources”

Instead, housing advocates say the state needs to spend more money on housing.

Aileen Joy, communications director for the Sacramento Housing Alliance, said an increase of state funding for affordable housing is a critical step in easing the burden caused by the crisis on all income levels.

“It comes down to the resources,” Joy said. “Our housing crisis is growing, but at the same time, folks are trying to do so much and to meet this huge need with less and less resources.

“We had some of the fastest growing rents in the nation and we also, just right in the Arden area, had California’s highest poverty rate increase in a single year. If we don’t take meaningful steps to address the housing crisis, to stop displacement, to build more affordable housing, all of those things are going to increase.”

(Click here to look at the proportions of renter-occupied properties and owner-occupied properties in California’s counties.)

Some advocates, like Buckley, are instead looking to November for solutions.

“I’d say that this governor still seems like he is going to be a hard sell on any other funding coming out of the general fund for affordable housing, so a lot of folks are looking to the next governor, and seeing what the candidates for governor are saying about affordable housing,” Buckley said.

Others in the legislature have attempted to tackle the housing crisis, including state Senator Scott Wiener, D-San Francisco.

One of those candidates, Lt. Governor Gavin Newsom, has made addressing the housing crisis a key part of his platform.

In a post to his Medium page, Newsom proposes increasing the amount of state funds used for a tax credit program from $85 million to $500 million to support the building of affordable housing.

As for the missing middle, Newsom suggests that the state “work with our corporate partners to create workforce housing serving middle-class families and moderate income households.”

Others in the legislature have attempted to tackle the housing crisis, including state Senator Scott Wiener, D-San Francisco.

“[California’s housing crisis] pushes families who aren’t wealthy out of their communities, and sometimes, out of the state entirely,” Wiener said during an April 17 Senate Transportation and Housing Committee hearing. “It pushes people into crushing commutes since there is simply nowhere that they can afford to live anywhere near where they work.”

Despite the support of a large coalition of housing advocates, SB 827 failed in committee on April 17.

“The status quo isn’t working. We need an enormous amount of new housing at all income levels. That means massive investment in subsidized housing for lower income people, including our poorest residents, and an overall significant increase in housing supply for our middle class.”

In January, Wiener introduced Senate Bill 827. Despite the support of a large coalition of housing advocates, the bill failed in committee on April 17.

The bill would have eased zoning restrictions, allowing for the development of more housing near transit hubs including rail or subway stations.

Weiner said after the vote that he would continue to push for the bill.

Putting it to a vote

Many housing advocates are currently lending their support to the Veterans and Affordable Housing Bond, which is slated for the November ballot. The measure would allocate $4 billion toward affordable housing programs and veteran’s home ownership program.

“About half of it would go to a program that builds essentially apartments that receive subsidies in order to be able to reduce their rents that are affordable to low-income households, and several pieces of the remaining $1.5 billion go to programs,” said Uhler. “Some of them are intended to help subsidize homeownership opportunities for low- and middle-income households.”

Renters who do not qualify for affordable housing struggle to find resources.

Legislative Analyst Mac Taylor said the $4 billion bond would “hopefully (increase) the supply somewhat,” but that the “need is so great” that it may not have much effect.. The state already allocates funds for low-income housing construction and housing for homeless, Taylor said.

But resources primarily intended for the middle income residents, however, remain scant, with the exception of some small scale, privately funded grant programs. .

Renters who do not qualify for affordable housing struggle to find resources.

Daniel Lopez lived in a two-bedroom apartment with his girlfriend and one other roommate. They shared the rent cost of $1,725, plus utilities.

They chose to leave when their lease was up because they couldn’t afford the rent increase.

Lopez currently lives with his girlfriend in his parents’ small guest home, paying $500 in rent.

Lopez and his girlfriend said their combined salary of almost $4,000 per month is not enough to rent a home.

In Citrus Heights, rent goes for about $1,800 for a two bedroom home,” Lopez said. “I want to buy a car before I buy a home. My car is salvaged and it has more than 200,000 miles on it.”

Lopez said the high costs of rent in the area have delayed his plans to start a family. If they had a child, Lopez said, it would be difficult to stay in the 418 square-foot home they currently occupy.

Some advocates say renters like Lopez could be helped by a repeal of the Costa-Hawkins Act, a decades-old state law that bans cities from adopting rent control ordinances, which would limit the price landlords can charge for rent.

Fernando Nadal, an organizer with the Alliance of Californians for Community Empowerment, said his group is working to repeal the Costa-Hawkins Act.

“The act allows corporations and homeowners to raise the rent as many times, as high as they want, without any control,” Nadal said.

Currently, ACCE is helping in the effort to place a rent control measure on the statewide ballot in November. On April 23, proponents of the repeal said they had enough signatures to qualify for a ballot initiative.

—

Ed’s Note: Reporters Barbara Harvey, Kristopher Hooks and Marivel Guzman wrote this story as part of a student project for the Journalism Program at California State University, Sacramento. Celina Matthias contributed to this report.

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.

Maybe she should move somewhere she *can* afford…