News

California’s new marijuana era

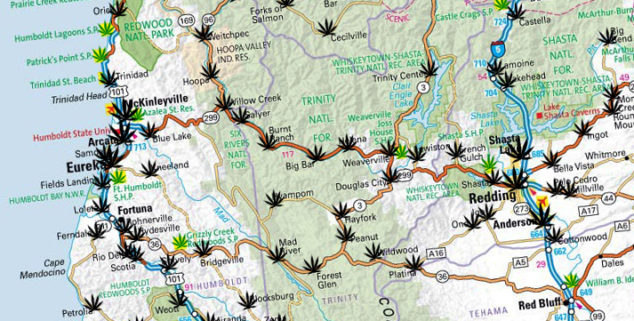

Illustration by Tim Foster, Capitol Weekly

Illustration by Tim Foster, Capitol WeeklyAt the heart of California’s Emerald Triangle is Humboldt County, a legendary locale in the world of weed, as prized by marijuana aficionados for its cannabis as Napa Valley is for its wine.

“Humboldt is the absolute, undisputed leader in cannabis,” said Luke Bruner, a local resident who has advised state and local officials on marijuana issues.

A lot is at stake. The statewide market in medicinal and recreational marijuana is worth about $6.6 billion

There are an estimated 12,000 pot growers in Humboldt County — or about one for every 11 residents — and officials want to protect the brand. They want to ensure that tax revenue is collected, a black market is throttled, violence is curbed and environmental rules are followed. They want Humboldt weed to carry a reputation and appellation like good wine.

So they have launched a pilot project — the first in California — to track medical marijuana from the young plants to the final processing and transport. A dozen local growers and others in the industry are participating, plus a handful of distributors and processors.

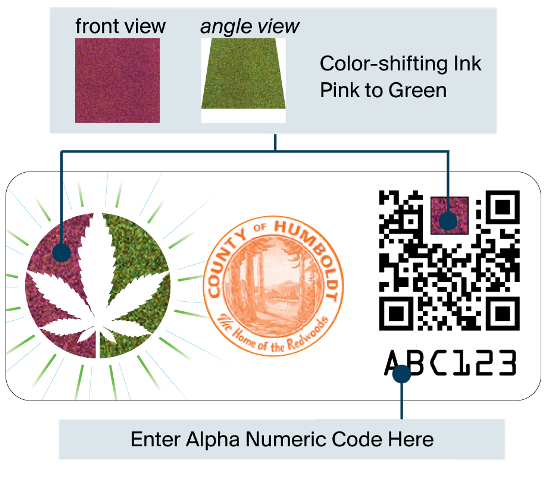

A stamped pouch of medicinal marijuana from Humboldt County.

“The bottom line: The project is working,” said Jeff Dolf, county agricultural commissioner.

With the voter-approved legalization of recreational cannabis use on Nov. 8, Humboldt’s “track and trace” pilot project likely will be expanded to meet the 2018 landscape. At least two counties, Mendocino and Yolo, may be following suit, and others are weighing their options.

Dealing with pot production in a legal and regulatory way is a far cry from the decades of police raids on plantations at harvest time — raids that drew international attention.

A lot is at stake. The statewide market in medicinal and recreational marijuana is worth about $6.6 billion, maybe more, according to an advisory group headed by state Treasurer John Chiang.

Humboldt County sensed the cultural changes evolving across California over marijuana use. They planned their medical marijuana project long before the November vote – they wanted to be ready.

Other counties are getting ready, too. Mendocino, also in the Emerald Triangle, is planning to establish its own trace program, and voters in several counties – including Lake, Solano, Monterey, Santa Cruz and Calaveras – approved measures to track legalized cannabis. Trinity, the third member of the Triangle, is considering it.

The goal is to fight smuggling, protect tax revenue and curb any black market.

Nearly two-thirds of California’s cannabis growers reside in the Emerald Triangle. Together, Humboldt, Mendocino and Trinity are home to about 35,000 cannabis growers, out of about 55,000 scattered across the state. Not surprisingly, they also are found in the fertile Central Valley, the nation’s richest farm belt.

The Humboldt program includes a stamp of certification to verify the weed’s provenance. The stamp is registered in an official database with anti-counterfeit controls similar to the way that state stamps are used on packs of cigarettes. “People are proud to have that stamp,” Bruner said.

Leaves on a marijuana plant. (U.S. Forest Service)

The company handling the Humboldt project under contract, a Switzerland-based firm called SICPA, has performed similar security functions for years for the state Board of Equalization for tobacco products, as well as for dozens of other states. The goal is to fight smuggling, protect tax revenue and discourage a black market.

Nobody is really sure how much cannabis tax money is at stake in Humboldt County, perhaps $4 million to $8 million annually for medical marijuana production, and potentially more if recreational marijuana production ends up in the mix. The basic tax is figured per square foot of growing area — $1 per square foot for outdoor grows, $2 for “mixed-light” indoor-outdoor grows and $3 per square foot for crops grown entirely in greenhouses.

“We put people at risk of injury and robbery as they cart around sacks of cash.” — State Treasurer John Chiang

Medical marijuana will be exempt from sales taxes starting in 2018, but recreational cannabis will be subject to the levy, dramatically boosting the potential state and local revenue. Statewide, the excise taxes on retail recreational marijuana under Proposition 64 will be 15 percent, generating about $1 billion a year, according to the Legislative Analyst’s Office. But the total tax load — including state and local taxes — may be a hefty 28 to 35 percent, which includes cultivation taxes and local sales taxes. Also, at some point, the large-acreage growers are likely to move in, displacing mom-and-pop operations.

“The landscape in relation to this industry is going to change significantly in the state,” Dolf said.

Commercial flower growers — many of whom have extensive greenhouse facilities — are watching that landscape closely.

“Not just in flower farming, but all through agriculture, people are looking at cannabis as a viable crop,” said Kasey Cronquist, the CEO of the California Cut Flower Commission. “Certainly, we have farms that those who invest in marijuana would like to have.” The nation’s premier cut-flower crop is in California’s Carpinteria Valley.

So far, he added, “there has been no sort of exodus or change in the cut-flower business.”

Statewide, taxable sales of medical marijuana in California was about $575 million during the first six months of 2016, according to the Board of Equalization. The board, which noted that the figure was likely a partial one, said some 1,023 accounts across the state paid $50.5 million in taxes during the period. However, more than two-thirds of marijuana-related businesses do not have bank accounts, according to Chiang, so tracking the money with precision is difficult.

The money is at the heart of the discussion about marijuana: It’s not about using cannabis, it’s all about banking the proceeds.

In a suburban Sacramento BOE office, a medical marijuana dispensary executive brought in $400,000 in cash in two suitcases while an armed CHP officer stood guard at the door.

By whatever estimate, big dollars are involved – and getting bigger.

In a cash-and-carry business where banks are loathe to allow growers, processors and dispensaries to have accounts, cannabis producers are tempting targets. The inability to bank funds triggers fear — and violence.

Pot plants in the grow room of a medical marijuana dispensary.

“We put people at risk of injury and robbery as they cart around sacks of cash,” Chiang said at the first meeting of his cannabis banking advisory group.

The Board of Equalization, which collects and distributes taxes, is receiving large cash payments at offices across the state.

In a suburban Sacramento BOE office, a medical marijuana dispensary executive brought in $400,000 in two suitcases while an armed CHP officer stood guard at the door. Similar deposits are common at BOE offices, which are not equipped to handle huge amounts of cash.

People in the cannabis industry “are afraid to drive with hundreds of thousands of dollars in their vehicles,” said Khurshid Khoja, general counsel of the California Cannabis Industry association. “A million in cash is a very inviting target.”

He cited two examples: A dispensary testing agent who was attacked inside his premises by a hammer-wielding assailant, and a Southern California cannabis industry executive who was kidnapped, taken to the desert and tortured to disclose his cache of cash.

Casey O’Neill, a grower, agreed, saying that growers and businesses need to be able to legitimately bank their funds, like any other legal business. Currently, they are forced to “figure out how to get a bank account without telling them (the banks) what you do,” O’Neill said.

“I’m about to start my third bank account, we’ve had two shut down already,” he said. “Being a farmer nowadays, you have to wear many hats, and accounting is often not the strongest hat of the farmer.”

California had more than 758,000 users of medicinal cannabis through March 2016.

“Luckily, we do have a bank,” said Phil Blurton, owner of an established Sacramento dispensary. “In seven years, I’ve been kicked out of five banks…. As soon as they find out that you are a cannabis dispensary, or anything to do with the cannabis business, they kick you out.”

Banks are federally regulated, and they are nervous about handling the funds of people who are producing a product designated as illegal under federal law. The federal government has classified cannabis as an illegal, addictive Class I drug — a position that has been the same for decades.

“The clear weight of the currently available evidence supports this classification,” the DEA noted in an April 2013 official policy document on its web site. “The campaign to legitimize what is called ‘medical’ marijuana is based on two propositions: first, that science views marijuana as medicine; and second, that the DEA targets sick and dying people using the drug. Neither proposition is true.”

But officials also noted that “the focus of federal resources should not be on individuals whose actions are in compliance with existing state laws,” which appeared to leave the door open for medicinal or recreational cannabis use in those states where it is legal.

Legally, then, there still is a gray area.

Diagram of a cannabis verification stamp. (Humboldt County)

Marijuana’s use in some form has been approved in California and 25 other states, as well as the District of Columbia. California had more than 758,000 users of medicinal cannabis through March 2016, according to ProCon.org, a group that tracks data on controversial issues. Nationally, there are about 1.2 million medicinal users.

“The machinery of the federal government has been clunking along behind the trending preferences of the American people,” Chiang said. He noted that federal representatives declined to participate in his working group’s first Capitol hearing. Those who did attend included growers, bankers, advocacy groups, law enforcement groups, local government officials and others.

In California, Proposition 64’s provisions targeting commercially sold recreational pot will be phased in through 2018, but other provisions went into effect immediately.

“The recreational aspect is in effect right now,” said Steve Wagstaffe, the district attorney of San Mateo County and the president of the California District Attorneys Association. Since Proposition 64’s passage, he added, “we have about 100 cases in which we filed felony charges for sale, and we’ve almost completed reducing those to misdemeanors.”

But the legal load remains complex.

When recreational cannabis is legally marketed and significantly taxed up to 35 percent or even more, there is a potential for a big black market and an incentive to sell large amounts under the table. In Colorado, which legalized recreational use two years ago, about 60 percent is legally sold, and the rest is peddled in a black market.

Already popular among smugglers are panga boats — small open boats powered by outboard motors that tote marijuana to isolated coastal areas late at night. In Monterey County, authorities seized an $18 million load in 2015 from a panga boat in the Mill Creek area near the San Luis Obispo County line. Last February off Santa Barbara, some 3,000 pounds of weed were confiscated from a panga boat. In San Mateo County, there have been cases of panga boat operators coming close to the coast, dumping their loads overboard to let the tide carry the pot in, then peeling away.

“We’ll find the black market and we’ll deal with it,” Wagstaffe said.

Want to see more stories like this? Sign up for The Roundup, the free daily newsletter about California politics from the editors of Capitol Weekly. Stay up to date on the news you need to know.

Sign up below, then look for a confirmation email in your inbox.

Anyone voting for to legalize marijuana use(even if one has a MD RX for getting such

(which is as easy to get as a candidate’s promise during an election)-should put their

name on a list where they voted.

Then all cost flowing from; crimes/regulation et will be split among the those voting for

such.

So Mr. Goodhue, in the same light as your posting; When a community or State votes for school bonds or road improvement bonds and those bonds pass and are enacted, only those who voted for the bond issuance should have to pay and not those who voted against the bond issuance? Is that your philosophy?

Perhaps you forgot that we live in a Republic governed by Majority Rule.

Great idea, Laurence! It follows, then, that any reduction in crime (as Colorado’s Gov. readily points out) should be credited to the cannabis purveyors: a check in the mail for the reduction in police time NOT spent busting some kid with a joint, the increased capture of real criminals, the cessation of other related damage done to property and person caused by alcohol & other ‘actually’ destructive drug use, etc.

And thanks for not being a conservative jerk that resists the future and the one thing that a future offers that the past does not: possibility for a better life. For us all.

Sorry pal but your prohibition reefer madness statement is gone with the 1950’s wind. It’s a new century and millions of tax collection dollars are at stake and the train is picking up speed. As of today 60% of VOTERS APPROVE of legal cannabis and your black market crimes are being replaced by a controlled and taxed industry

[…] • There are roughly 12,000 pot growers in Humboldt County — or about one for every 11 residents. [Capitol Weekly] […]

Your theory should also apply to liquor, guns and the tobacco industry. But why should the buyer pay? Why no the business’ who are the purveyors of these fine products? Oh yea. The government passed laws exempting the corporate killers from liability from the injuries their products caused. But should there be a ledger that keeps track of the “damage” caused by the legal use of marijuana, the “cost” must be off-set by the cost the state is NOT paying to jail these “criminals” anymore. I think the cost savings from NOT inprisioning people, sometimes for 20 plus years, will far outweigh the cost of any damage that you see coming in the future. P.S. I do not smoke pot now, nor never have. To each his own.